Nylon, a synthetic polymer, is widely used in various industries, including textiles, automotive, industrial, and consumer goods. Understanding the nylon price trend is crucial for manufacturers, traders, investors, and industry stakeholders to make informed decisions. This article explores the factors influencing nylon prices and provides an overview of recent price trends.

1. Introduction to Nylon

Nylon, a family of synthetic polymers, was first produced in 1935 by DuPont. It is known for its strength, durability, and resistance to heat and chemicals, making it a versatile material for many applications. The price of nylon is influenced by several factors, including supply and demand dynamics, raw material prices, production costs, technological advancements, and market speculation.

2. Factors Influencing Nylon Prices

Several factors contribute to the fluctuations in nylon prices. Understanding these factors is crucial for predicting price trends and making informed decisions.

Supply and Demand: Global supply and demand dynamics significantly impact nylon prices. Supply disruptions due to production issues, plant shutdowns, or geopolitical conflicts can lead to price spikes. Conversely, increased production and supply can drive prices down.

Raw Material Prices: The price of raw materials, such as crude oil and natural gas, which are used to produce caprolactam and adipic acid (key components of nylon), significantly affects nylon prices. Fluctuations in oil and gas prices can lead to changes in nylon production costs.

Production Costs: The cost of producing nylon, including energy costs, labor, and maintenance of production facilities, affects its market price. Higher production costs can lead to increased nylon prices.

Technological Advancements: Innovations in polymerization technology and improvements in production efficiency can impact the cost of nylon production, influencing prices.

Industrial Demand: Demand from key industries, such as textiles, automotive, and industrial applications, drives nylon prices. Technological advancements and economic growth in these sectors influence demand.

Currency Exchange Rates: Since nylon is traded globally, currency exchange rates can affect prices. A stronger US dollar, for instance, can make nylon more expensive for foreign buyers, reducing demand and prices.

Market Speculation: Speculative trading and market sentiment can cause short-term price fluctuations. Investor behavior, driven by market news and trends, can lead to rapid changes in nylon prices.

Environmental Regulations: Stricter environmental regulations and sustainability practices can impact nylon production costs and availability, influencing prices.

3. Recent Nylon Price Trends

Recent nylon price trends have been shaped by a combination of the factors mentioned above. Here, we examine the price trends over the past few years.

2019-2020:

During this period, nylon prices experienced moderate fluctuations. The primary drivers were changes in global supply and demand, raw material prices, and geopolitical events.In 2019, prices were relatively stable but began to decline towards the end of the year due to increased production capacity and a slowdown in industrial demand.The COVID-19 pandemic in 2020 caused significant disruptions in supply chains and reduced industrial activity, leading to a decrease in nylon demand and prices. However, increased demand for medical and protective equipment provided some support to nylon prices.

2021:

As global economies began recovering from the pandemic, nylon prices surged. The rebound in demand, particularly from the automotive and textile sectors, coupled with supply chain disruptions, pushed prices higher.Higher raw material and energy costs significantly increased production costs, contributing to the upward trend in nylon prices.

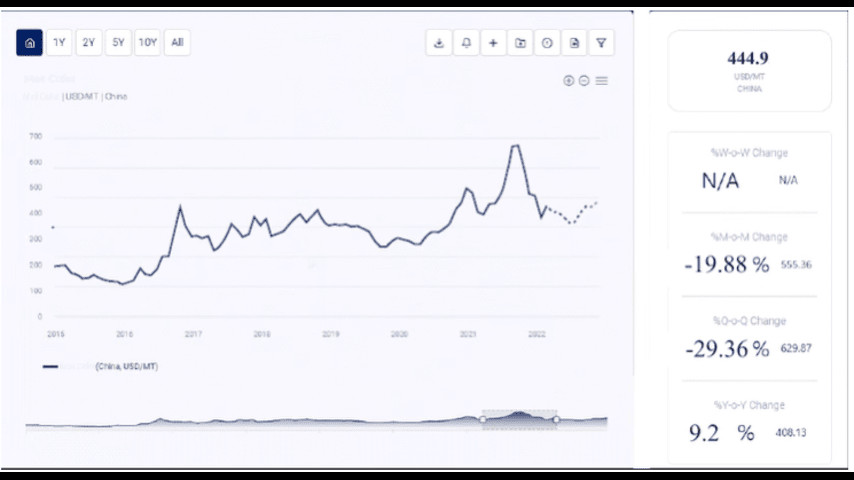

2022:

Nylon prices continued to trend upwards in early 2022, driven by ongoing supply chain challenges, strong demand from the automotive and industrial sectors, and geopolitical tensions, particularly the Russia-Ukraine conflict, which affected global energy supplies.Throughout the year, prices remained volatile, influenced by changes in industrial demand, raw material prices, and technological advancements in production efficiency.

2023:

The first half of 2023 saw some stabilization in nylon prices as supply chains adapted and production levels normalized. However, prices remained elevated compared to pre-pandemic levels.Demand from the automotive, textile, and industrial sectors continued to support higher prices. Geopolitical uncertainties and energy market volatility kept the market cautious, contributing to price fluctuations.4. Regional Nylon Price Trends

Nylon price trends can vary significantly across different regions due to local supply and demand dynamics, production costs, and government policies.

North America:

In North America, nylon prices were influenced by domestic production levels, energy costs, and demand from the automotive and textile industries.US industrial policies and trade agreements also played a crucial role in shaping nylon prices.

Asia:

Asia, particularly China and India, experienced significant price variations due to high demand from the textile and automotive sectors.Government policies promoting industrial growth and technological advancements influenced regional prices.

Europe:

Europe saw price trends influenced by energy costs, industrial demand, and environmental regulations. The region’s reliance on imported energy and the transition towards renewable energy sources significantly impacted nylon prices.The Russia-Ukraine conflict led to increased energy prices, further driving up nylon production costs and prices.

Middle East and Africa:

The Middle East and Africa, with growing industrial activities, experienced price trends driven by domestic production, energy costs, and demand from the manufacturing sector.Infrastructure challenges and political stability also impacted nylon prices in these regions.5. Future Outlook for Nylon Prices

Predicting future nylon prices involves considering various dynamic factors. Here are some key points to consider:

Conclusion

Recent trends have shown significant volatility due to the COVID-19 pandemic, geopolitical tensions, and energy market volatility.

Looking forward, the global energy transition, technological advancements, geopolitical stability, industrial demand, and environmental regulations will play crucial roles in shaping nylon prices. Stakeholders must stay informed about these factors to navigate the market effectively and make informed decisions.

By understanding the various elements that drive nylon prices, producers, consumers, and policymakers can better anticipate market changes and develop strategies to manage price risks and ensure a stable supply of this essential polymer.