Tracking your earnings over time is crucial for effective financial management. One of the best ways to do tA pay stub is an essential financial document that provides detailed information about your earnings, deductions, and net pay for a specific pay period. Not only does it serve as proof of income, but it can also be a valuable tool for tracking your earnings over time. In this blog, we will explore how you can use your pay stubs to monitor your financial progress and highlight the benefits of using a paystub generator free to ensure accuracy and convenience. Additionally, we’ll delve into the importance of paycheck stubs and how they can help you achieve better financial management.

Understanding Pay Stubs

What is a Pay Stub?

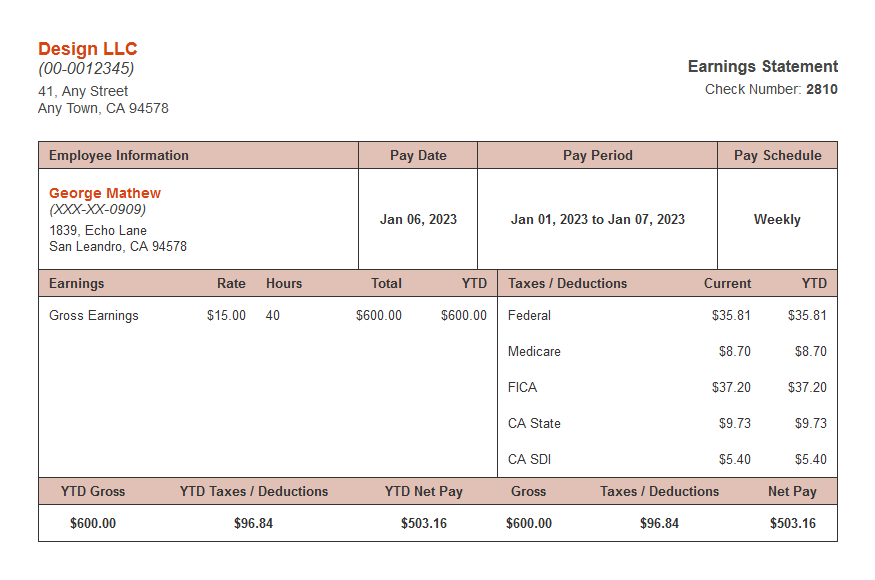

A pay stub, also known as a paycheck stub, is a document that accompanies your paycheck. It provides a breakdown of your earnings for a specific pay period, including gross pay, deductions (such as taxes and benefits), and net pay (the amount you take home). Pay stubs can also include information about year-to-date earnings, hours worked, and other relevant details.

Components of a Pay Stub

To effectively track your earnings, it’s important to understand the key components of a pay stub:

- Gross Pay: The total amount earned before any deductions.

- Net Pay: The amount you take home after all deductions.

- Federal Income Tax: The amount withheld for federal taxes.

- State and Local Taxes: The amount withheld for state and local taxes, if applicable.

- Social Security and Medicare: Deductions for Social Security and Medicare contributions.

- Other Deductions: Includes health insurance premiums, retirement contributions, union dues, etc.

- Year-to-Date Totals: Cumulative totals for earnings and deductions since the beginning of the year.

Using Pay Stubs to Track Earnings

1. Monitor Income Consistency

Regularly reviewing your pay stubs helps you ensure that your income remains consistent. Any discrepancies, such as unexplained reductions in pay or missing hours, can be identified and addressed promptly. Consistency in income is crucial for budgeting and financial planning.

2. Track Overtime and Bonuses

Pay stubs detail any overtime hours worked and bonuses received. By tracking these amounts, you can gain insights into how often you work overtime and the impact of bonuses on your overall income. This information can be useful for negotiating future raises or assessing your work-life balance.

3. Analyze Deductions and Benefits

Understanding the deductions on your pay stub is essential for financial planning. Regularly reviewing these deductions helps you ensure that they are accurate and as expected. If you notice any changes or errors, you can address them with your employer or payroll department.

4. Assess Tax Withholding

Your pay stub provides information about the amount of federal, state, and local taxes withheld from your paycheck. By tracking these amounts, you can ensure that you are not under- or over-withholding taxes. This is important for avoiding surprises during tax season and for making adjustments to your W-4 form if necessary.

5. Monitor Year-to-Date Earnings

The year-to-date (YTD) section of your pay stub shows your cumulative earnings and deductions for the year. This information is valuable for tracking your progress towards financial goals, such as saving a certain amount or staying within a budget. It also helps you prepare for tax filings by providing an overview of your annual income.

Benefits of Using a Paystub Generator Free

A paystub generator free is a tool that allows you to create accurate pay stubs based on your earnings and deductions. Here are some benefits of using a free pay stub generator:

Accuracy

Using a paystub generator ensures that your pay stubs are accurate and free from errors. You can input your earnings, deductions, and other relevant information to generate a precise pay stub. This reduces the risk of discrepancies and helps you maintain accurate financial records.

Convenience

A paystub generator is easy to use and can quickly generate pay stubs. This is especially useful for self-employed individuals, freelancers, or small business owners who need to create pay stubs for themselves or their employees. You can generate pay stubs anytime and from anywhere, making it a convenient solution for managing your finances.

Customization

Many paystub generators offer customization options, allowing you to tailor the pay stub to your specific needs. You can include your company logo, choose different formats, and add or remove specific fields. This customization ensures that your pay stubs meet your requirements and look professional.

Record Keeping

By using a paystub generator, you can easily keep track of your pay stubs and maintain a comprehensive record of your earnings. This is important for financial management, tax preparation, and any situations where you need to provide proof of income.

Importance of Paycheck Stubs

Financial Planning

Paycheck stubs provide detailed information about your earnings and deductions, which is essential for effective financial planning. By regularly reviewing your pay stubs, you can monitor your income, control your spending, and make informed financial decisions.

Budgeting

Tracking your earnings with paycheck stubs helps you create and stick to a budget. You can allocate funds for different expenses, savings, and investments based on your net pay. This helps you manage your money more efficiently and achieve your financial goals.

Loan Applications

When applying for loans or mortgages, lenders often require proof of income. Paycheck stubs serve as valid documentation of your earnings and employment status. By maintaining accurate and up-to-date pay stubs, you can provide the necessary information to secure loans and other financial products.

Tax Preparation

Paycheck stubs provide valuable information for tax preparation. They detail your earnings, tax withholdings, and deductions, making it easier to file your tax returns accurately. Having a complete record of your pay stubs also helps in case of any discrepancies with your tax filings.

Employment Verification

Paycheck stubs can be used for employment verification purposes. Whether you’re applying for a new job, renting an apartment, or seeking credit, paycheck stubs serve as proof of your employment and income. This verification is often required by employers, landlords, and creditors.

Conclusion

Using your pay stub to track your earnings over time is an effective way to manage your finances and achieve your financial goals. By regularly reviewing your pay stubs, you can monitor income consistency, track overtime and bonuses, analyze deductions, assess tax withholding, and monitor year-to-date earnings. Utilizing a paystub generator free can ensure accuracy, convenience, and customization in generating your pay stubs. Additionally, paycheck stubs play a crucial role in financial planning, budgeting, loan applications, tax preparation, and employment verification. By leveraging the information on your pay stubs, you can make informed financial decisions and maintain better control over your finances.